Trade License

Trade License is being introduced in Bangladesh under The Municipal Corporations [Taxation] Rules, 2009. It is issued when any entrepreneur applied through the license form. The process is managed by the City Corporation or city council where the business operates. A license is issued exclusively in the name of the company and such a license is not transferable. A renewed license is provided by the concerned staff of the zonal taxation office. A fee for trade license has to be deposited at any Bank as indicated in the form..

Required Documents for Trade License:

2. Location Map

3. Copy of fire certificate

4. Declaration on the non-judicial stamp of Tk. 150/- to abide by the rules and regulation of DCC

5. One copy of passport size photograph

In the case of Limited Company :

2. Certificate of In-Corporation

Renewal of Trade License

Trade License is mandatory for every form of business entity in Bangladesh. It is issued by the local government of the respective areas. Every business entity must obtain a Trade License from each local government where it operates. If a business entity has more than one place of business, it must obtain a Trade License from each local government. It is issued for one year and has to be renewed annually. Trade License attracts some government fees, which usually depends on the types of business.

Below, we have described the process of obtaining a license for businesses that operate within the Dhaka City Corporation area. Other local governments have similar rules. You are advised to contact the respective local government for more information.

TRADE LICENSE FOR A COMMERCIAL FIRM

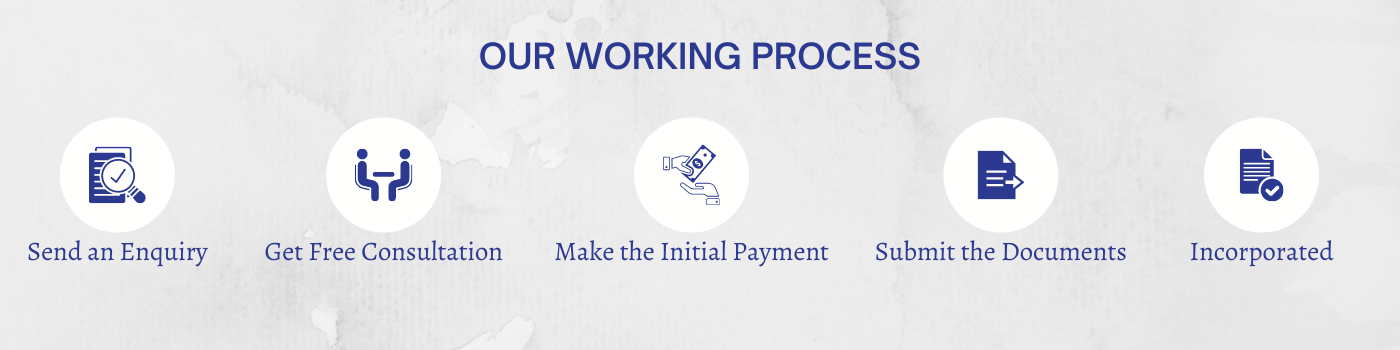

PROCESS STEPS

STEP 1: PROCURE THE PROPER FORM FROM THE PROPER OFFICE.

Dhaka City Corporation (DCC) has two forms for a trade license depending on the type of business. A commercial firm must use the “K” Form. Even though the ten zonal offices use the same K Form, a business must buy the form from its respective zonal office. A seal and the initials of the officer selling the form is what distinguishes it from that of other zones. The form costs Tk. 10.

STEP 2: GET CERTIFICATION FROM THE LOCAL WARD COMMISSIONER.

After the form is completed it has to be submitted to the local ward commissioner for validation.

STEP 3: COLLECT LICENSE BOOK BY TK. 50 AND SUBMIT APPLICATION WITH SUPPORTING DOCUMENTATION TO DCCS ZONAL OFFICE.

For the K Form, a rent receipt for the premises where the business is operating from or, if owned, the municipal tax payment receipt has to be provided. Supporting documents include:

STEP 4: PAY PREDETERMINED FEE AND COLLECT TRADE LICENSE.

After inspection by the LS is concluded, the business is asked to go to the DCC office to pay the predetermined fee and collect their trade license. The fee schedule depends on the business category under which the application was filed.

STEP 5: SIGNBOARD FEE FOR TRADE LICENSE

When collecting the trade license, a signboard fee has to be paid as well. For all types of business, the signboard fees will payable 30% of the License fee.

TRADE LICENSE FOR A MANUFACTURING FIRM

PROCESS STEPS

STEP 1: PROCURE THE PROPER FORM FROM THE PROPER OFFICE.

The “I” Form will have to be purchased for Tk. 10 from the DCC zonal office where the manufacturing firm has to submit its application.

STEP 2: GET CERTIFICATION FROM THE LOCAL WARD COMMISSIONER.

The completed form has to be validated by the local ward commissioner.

STEP 3: SUBMIT APPLICATION WITH SUPPORTING DOCUMENTATION.

Supporting documents include:

STEP 4: AWAIT ENQUIRY BY THE LICENSING SUPERVISOR (LS).

Upon submission of the form, the LS usually goes to the business entity for a visit to verify the information provided.

STEP 5: PAY PREDETERMINED FEE AND COLLECT TRADE LICENSE.

After inspection by the LS is concluded, the business is asked to go to the DCC office to pay the predetermined fee and collect their trade license. The fee schedule depends on the business category under which the application was filed.

STEP 6: SIGNBOARD FEE

When collecting the trade license, a signboard fee has to be paid as well. For all types of business, the signboard fees will payable 30% of the License fee.

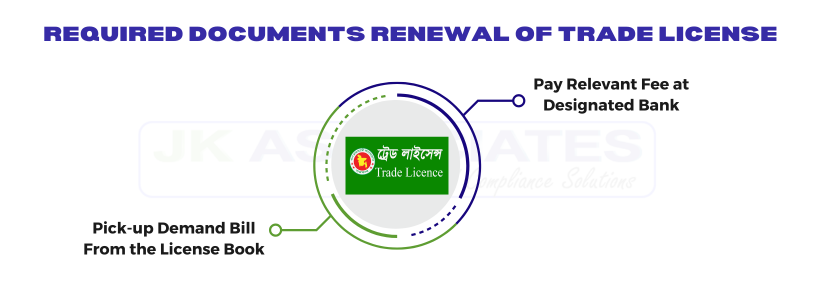

RENEWAL OF TRADE LICENSE

The renewal process is comparatively routine and no inspection is required. When the license comes up for renewal the business has to go the LS.

PROCESS STEPS

STEP 1: PICK-UP DEMAND BILL FROM THE LICENSE BOOK (THIS BOOK IS VALID FOR FIVE YEARS)

Upon checking the expiring trade license, the LS fills in the particulars in a demand bill and gives the booklet to the business. The demand bill is a four-page booklet similar to a bank deposit slip. The same information is filled into all the pages: one page is for the bank and one is for the business.

STEP 2: PAY RELEVANT FEE AT DESIGNATED BANK

Deposit designated bank through demand bill and it will automatically renew the license.

One of the important steps in starting a business in Bangladesh is acquiring a license. A businessman must obtain a business license from the respective business area’s City Corporation or City Council. Here, in this post in detail, we will explain the procedure of obtaining a trade license in Bangladesh, the fees, and finally the renewal process of trade license in Bangladesh.

Step by Step Process of acquiring Trade License for any Business Entity

The acts/legal authorities which overseen the process of obtaining the trade license in Bangladesh are

Below is an overview of the process of obtaining a trade license for companies operating within the zone of Dhaka City Corporation. Many local authorities have similar rules.

The trade license filled-in application form must be accompanied by the required documents.

Required Documents:

Related Articles

Startup Packages

Read Startup Packages

Project Profile

Read Project Profile

Trade License

Read Trade License

Export License

Read Export License

Import License

Read Import License

Loan Consultancy

Read Loan Consultancy

RJSC Return Filling

Read RJSC Return

Partnership Registration

Read Partnership Reg

Society Registration

Read Society Reg

One Permission Company

Read One Permission

Company Formation

Read Company Formation

BSTI Permission

Read BSTI Permission

Startup Packages

Read Startup Packages

Project Profile

Read Project Profile

Trade License

Read Trade License

Export License

Read Export License

Import License

Read Import License

Loan Consultancy

Read Loan Consultancy

RJSC Return Filling

Read RJSC Return

Partnership Registration

Read Partnership Reg

Society Registration

Read Society Reg

One Permission Company

Read One Permission

Company Formation

Read Company Formation

BSTI Permission

Read BSTI PermissionTrade License FAQ