Foreign Company Registered Address

What is a foreign company’s registered address

A foreign company registered address is a physical location where a company operating in a foreign country is officially registered with the local government authorities. This address is typically used for legal and administrative purposes, such as receiving official correspondence from the local authorities or filing annual reports.

In many countries, it is a legal requirement for companies to have a registered address to conduct business. The address must be a physical location where the company can receive mail and other communications from the local authorities. This requirement is in place to ensure that the government can communicate effectively with the company, and that the company is accountable to the local laws and regulations.

Why is it necessary for a foreign company to have a registered address

Having a foreign company registered address can also provide other benefits to the company, such as establishing a physical presence in the country and building trust with local customers, suppliers, and partners. It can also help the company to demonstrate compliance with local regulations, which can be important when seeking investment or partnerships in the country.

Overall, having a foreign company registered address is essential for any company operating in a foreign country, as it enables them to comply with local laws and regulations and establish a legal presence in the country. It’s important to work with a reputable consultancy firm with expertise in foreign company registered address services to ensure that the address is properly registered and that the company remains compliant with all applicable regulations.

What services does ‘JK Associates’ provide regarding foreign company registered addresses?

The services that a ‘JK Associates’ provide regarding foreign company registered addresses:

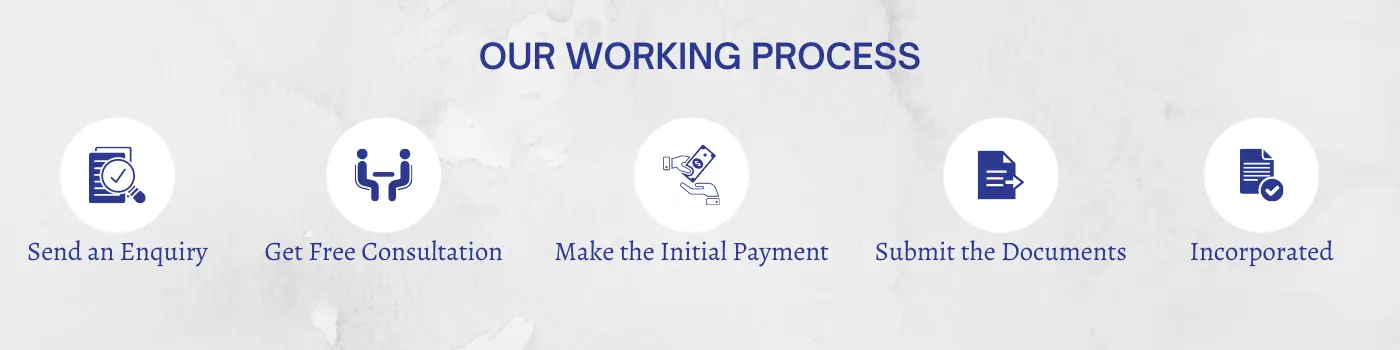

The process for registering a foreign company address

A general overview of the process for registering a foreign company address are given:

The first step is to consult with the consultancy firm to determine the requirements for registering a foreign company address in the country where the company is operating. The firm will provide guidance on the necessary documentation and other requirements needed to complete the registration process.

Requirements for a foreign company registered address

Requirements for a foreign company registered address may vary depending on the country where the company is operating. Some of the requirements that may be necessary for a foreign company to register a local address in certain countries:

What criteria should be considered when selecting a registered address

Related Articles

Foreign Company Formation

Read Foreign Company...

Work Permit Visa In Bangladesh

Read Work Permit..

Private Investment VISA

Read Private Investment..

Foreign Company Director Service

Read Foreign Company Dir..

Foreign Delegates

Read Foreign Delegates

Foreign Company Registered Address

Read Foreign Company..

Foreign Direct Investment

Read Foreign Direct..

BIDA Permission

Read BIDA Permission

Foreign Company Formation

Read Foreign Company...

Work Permit Visa In Bangladesh

Read Work Permit..

Private Investment VISA

Read Private Investment..

Foreign Company Director Service

Read Foreign Company Dir..

Foreign Delegates

Read Foreign Delegates

Foreign Company Registered Address

Read Foreign Company..

Foreign Direct Investment

Read Foreign Direct..

BIDA Permission

Read BIDA PermissionForeign Company Registered Address FAQ