Value Added TAX

Monthly VAT Return – in View of Bangladesh

This paper represents an overview of Value Added Tax (VAT) in Bangladesh. It depicts the basic features of Value Added Tax and its implication, and importance in the growing economy of Bangladesh. Bangladesh faces many problems in raising sufficient tax revenues to fund its economic and social development. To address this problem and to improve economic efficiency and growth, a major tax reform program was initiated in 1991 which centered on the introduction of a value-added tax (VAT) to replace a range of narrowly-based consumption taxes. This study works as a linkage between theory and practice on Value Added Tax. The article represents the social and economic development of the country with the basic awareness which is going at a steady pace among the people and the organization considering it as a key to further economic Development. The awareness of Value Added Tax (VAT) is not very old, but still within a short span of time it has shown a remarkable change in the corporate sector and the economy of the country. It has developed a complete sense of care and responsibility towards the country and the welfare of the people.

1. Introduction

A value-added tax or value-added tax (VAT) is a form of consumption tax. From the perspective of the buyer, it is a tax on the purchase price, whereas, from the seller‘s point of view, it is a tax only on the "value-added" to a product, material or service, at the stage of its manufacture or distribution. The manufacturer remits to the government the difference between these two amounts and retains the rest for themselves to offset the taxes them

2. An Overview of Value Added Tax

Referred to as a sort of national sales tax, though it functions very differently. Sales tax is imposed on the total retail price of the item sold, while VAT tax is imposed on the value added at each stage of production and distribution. And though more complicated than sales tax, value-added tax systems have more checks against tax fraud because the tax is assessed at more than one point in the distribution process.

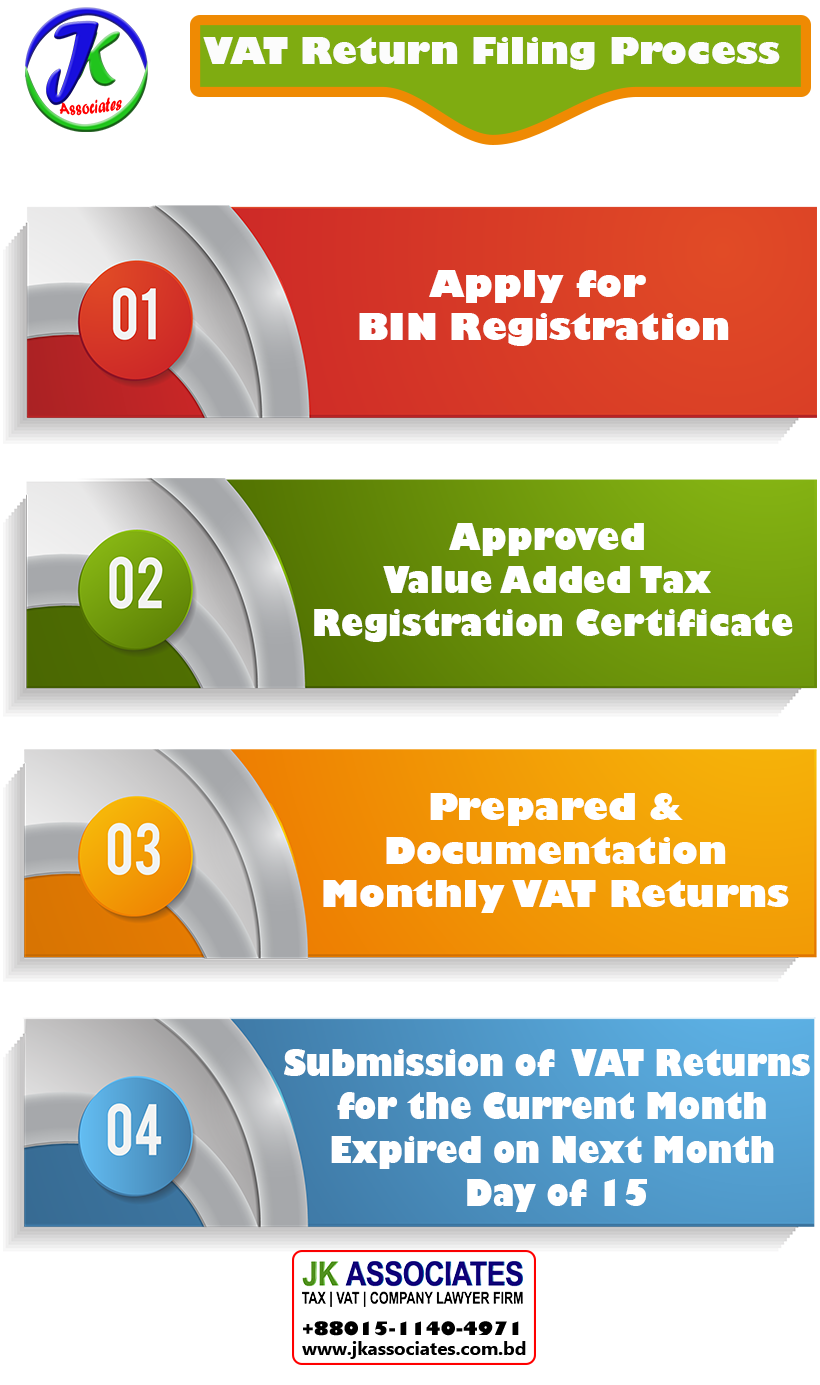

3. The Vat Assessment Process

The process of assessing value-added tax occurs roughly as follows:

4. Basic Characteristics of Value Added Tax

Basis for VATs

Related Articles

BIN Registration

Read BIN Reg

Corporate TAX

Read Corporate TAX

E-TIN Certificate

Read E-TIN

Individual TAX

Read Individual

Value Added TAX

Read Value Added TAX

BIN Registration

Read BIN Reg

Corporate TAX

Read Corporate TAX

E-TIN Certificate

Read E-TIN

Individual TAX

Read Individual

Value Added TAX

Read Value Added TAXValue Added Tax FAQ